A Mixed Bag for IPOs: How Crypto and AI Impacted 2025 Performance

The world of initial public offerings (IPOs) has always been a dynamic and sometimes unpredictable arena for investors. As we look back on 2025, it becomes evident that the performance of US IPOs was anything but stellar, primarily due to the significant influence of cryptocurrency and artificial intelligence (AI) on the market. In fact, many investors would have fared better had they opted to invest in the S&P 500 index rather than diving into the turbulent waters of IPOs.

The State of US IPOs in 2025

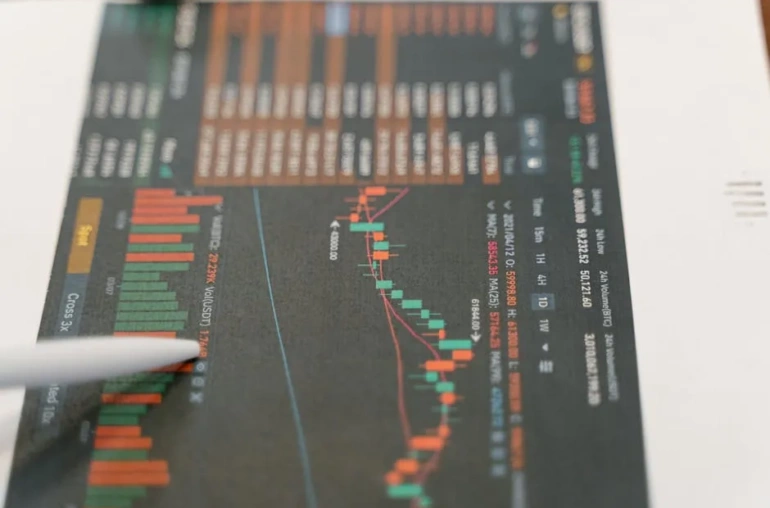

2025 was characterized by a mixed performance among US IPOs. While some companies made a splash, others struggled to find their footing, leading to an overall lackluster year for new public offerings. The volatility in the cryptocurrency market, coupled with the rapid advancements and public interest in AI technologies, played a significant role in shaping the landscape for IPOs.

Cryptocurrency’s Influence

The cryptocurrency market has been known for its unpredictable nature, and in 2025, this volatility had a direct impact on investor sentiment regarding IPOs. Many potential investors were hesitant to commit funds to new stocks when the allure of digital currencies seemed to offer quicker returns. This shift in focus toward crypto investments meant that capital typically reserved for traditional IPOs was diverted, leaving many companies struggling to attract sufficient interest and funding.

AI Public Debuts and Their Impact

On the flip side, the surge in AI technologies also altered the IPO landscape. Companies specializing in AI saw a significant uptick in interest, but this did not translate to a universally positive performance for all IPOs. The hype surrounding AI led to inflated expectations, and when some of these companies failed to deliver on their promises, it created a ripple effect that dampened overall investor confidence in new public offerings.

Comparing IPOs to the S&P 500

As the year progressed, it became increasingly clear that investing in the S&P 500 would have been a more prudent choice for many. Historically, the S&P 500 has provided a relatively stable return on investment, especially during turbulent market conditions. In contrast, the unpredictable nature of the IPO market in 2025 left many investors disappointed.

Those who opted for the S&P 500 likely enjoyed steadier gains, while IPO enthusiasts faced the challenges of a market heavily influenced by external factors such as cryptocurrency volatility and AI hype.

Looking Ahead

As we move forward, investors will need to remain vigilant and adaptable. It’s crucial to analyze market trends and understand what external influences may shape the performance of IPOs in the future. Both cryptocurrency and AI are expected to continue evolving, and their interplay with traditional investment opportunities will be a significant factor in determining the success of future public offerings.

In conclusion, while 2025 was a challenging year for US IPOs, it serves as a reminder of the complexities of the investment landscape. Investors should weigh their options carefully and consider diversifying their portfolios to mitigate risks associated with volatile markets.