Bitcoin’s Crossroads: Bulls and Bears Battle for Control

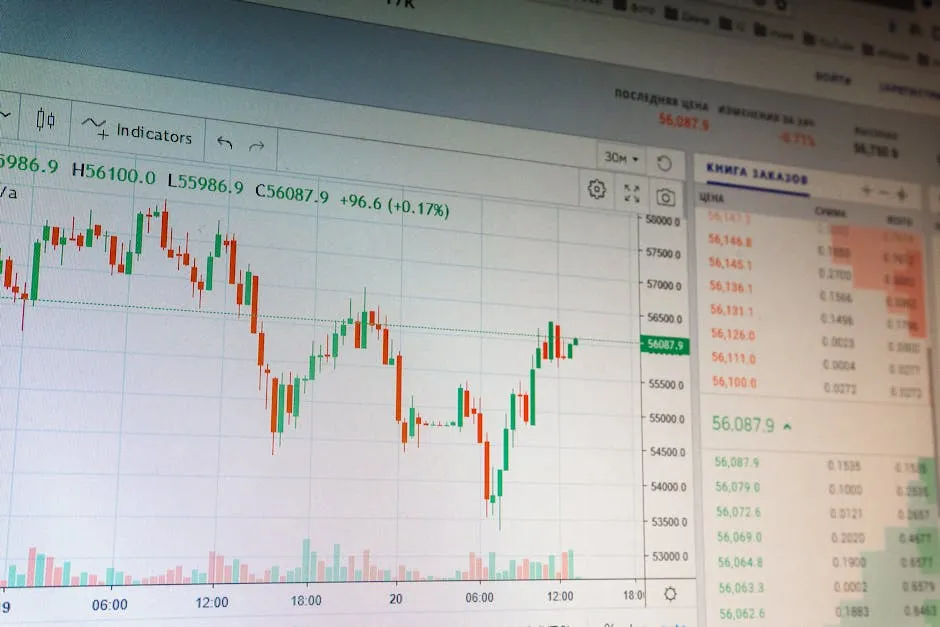

The Bitcoin market is currently a theater of conflicting narratives, leaving traders and investors to parse through a cacophony of predictions. After a sharp rejection from levels above its 2021 all-time high, BTC finds itself at a critical juncture. Analysts are deeply divided on the immediate path forward, with some forecasting a swift run to fill a significant price gap, while others warn of a return to painful macro lows.

The Bullish Case: The $84,000 Futures Gap

On the optimistic side, a compelling technical pattern is drawing attention. A notable “futures gap” exists around the $84,000 mark on certain trading charts. These gaps occur when the price of Bitcoin futures opens significantly higher or lower than the previous close, leaving a void in the price chart that the market often feels compelled to “fill” later. Proponents of this theory argue that this magnetic pull towards $84,000 could act as a powerful short-term catalyst, suggesting the price may rally to that level “very soon” to close the imbalance.

This target represents a clear milestone that would signify a decisive break into uncharted territory, potentially fueling a new wave of bullish sentiment and FOMO (Fear Of Missing Out) among institutional and retail investors alike.

The Bearish Warning: A Retest of Macro Lows

Contrasting sharply with the gap-filling thesis is a more cautious, if not outright bearish, outlook. Several market observers point to concerning macroeconomic headwinds, potential regulatory pressures, and fragile on-chain metrics. They warn that the recent rejection from higher prices is a classic sign of distribution and weakness, not a simple consolidation.

This camp believes that Bitcoin could be setting up for a deeper correction, one that might retest the significant lows established during the last major bear market cycle. Such a move would shake out over-leveraged positions and test the conviction of long-term holders, potentially creating a stronger foundation for a future rally—but only after considerable short-term pain.

What This Means for Traders and Investors

The stark divergence in forecasts highlights the extreme uncertainty and volatility inherent in the current crypto landscape. For active traders, this environment demands rigorous risk management, as whipsaw price action can quickly liquidate positions on both sides of the market.

For long-term investors, the noise underscores the importance of core strategy. Whether the price fills an $84,000 gap or revisits lower levels, the fundamental thesis for Bitcoin often remains unchanged for its proponents. The key is to navigate the short-term turbulence without losing sight of the long-term horizon, ensuring one’s portfolio can withstand either outcome.

As always, in a market driven by sentiment and speculation, only time will tell which narrative prevails. The coming weeks will be crucial in determining whether Bitcoin gathers strength for a historic breakout or succumbs to broader pressures for a significant correction.