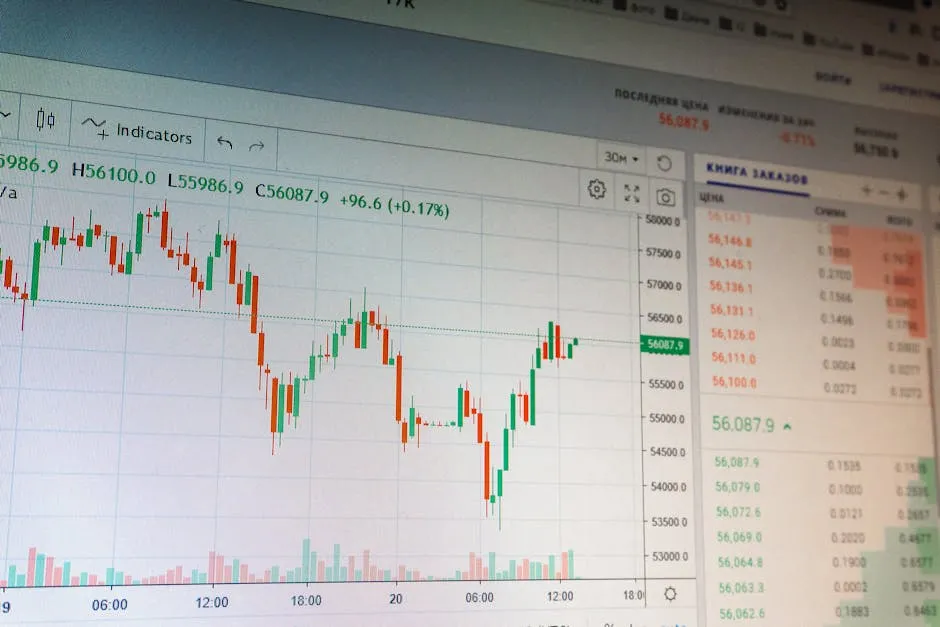

Bitcoin’s Sharp Decline Tests Key Support Levels

The cryptocurrency market experienced a significant downturn today, with Bitcoin leading the charge downward. The flagship digital asset plunged to a price point below $73,000, a level not seen in over fifteen months. This move effectively broke through its previous low from November 2024, signaling a deepening correction and putting the crucial $70,000 support zone firmly in the spotlight for traders and analysts.

Market-Wide Pressure and Liquidations

The sell-off was not isolated to Bitcoin. The broader digital asset market felt the pressure, resulting in substantial forced closures of leveraged trading positions. Data indicates that total liquidations across the crypto market neared the $800 million mark within a 24-hour period. These liquidations, where exchanges automatically close positions when traders lack sufficient funds to maintain them, often exacerbate price movements, creating a feedback loop of selling pressure.

This environment highlights the inherent volatility of the cryptocurrency space, even for established assets like Bitcoin. While long-term narratives around institutional adoption and store of value remain, short-term market dynamics are currently dominated by risk-off sentiment and the unwinding of speculative bets.

Focus Shifts to the $70,000 Zone

With the new low established, all eyes are now on how Bitcoin behaves around the $70,000 psychological and technical support level. This area is viewed by many market participants as a critical line in the sand. A decisive break and sustained trade below $70,000 could open the door to further declines, potentially testing lower support areas.

Conversely, a strong bounce and reclaim of price above this zone could suggest that the current downturn is a deep but healthy correction within a larger bullish trend. Market sentiment will likely remain fragile until Bitcoin can demonstrate stability and establish a new foundation for price discovery.

For investors, this period serves as a stark reminder of the importance of risk management. The rapid price swings and associated liquidations underscore why many advocates stress only investing what one can afford to lose and considering longer-term holding strategies to weather such storms.