Bitcoin’s Bullish Momentum Faces a Test

The recent rally in Bitcoin has hit a significant speed bump. After flirting with new highs, the price of BTC is now testing a crucial psychological level, dancing precariously around the $80,000 mark. This pullback has been accompanied by a notable shift in the derivatives market, where traders are expressing growing caution.

Options Market Flashes Warning Signs

One of the clearest indicators of this changing sentiment comes from the Bitcoin options market. Data shows that traders are increasingly positioning for potential downside, with a surge in bearish bets. The so-called “fear and greed” signals from options pricing have tilted sharply towards fear, suggesting that professional traders are hedging against or betting on a deeper correction.

This shift is significant because the options market often reflects the expectations of more sophisticated institutional players. When these traders start buying puts (options that profit from a price drop) in larger volumes, it can be a leading indicator of market sentiment turning sour.

The ETF Outflow Factor

Adding pressure to Bitcoin’s price is a recent trend of outflows from U.S. spot Bitcoin ETFs. After a period of massive inflows that helped fuel the rally, some funds have begun to see money exit. This removes a key source of consistent buying pressure that the market had grown accustomed to.

The relationship is straightforward: when ETFs see net outflows, the fund issuers are forced to sell Bitcoin from their holdings to meet redemptions, creating sell-side pressure on the spot market. This dynamic is now working against the price, coinciding with the nervousness seen in the options arena.

Will the Dip Buyers Return?

The big question now is whether the famous “BTFD” (Buy The F*ing Dip) mentality will re-emerge. Bitcoin has a long history of sharp corrections within broader bull markets, where temporary sell-offs are quickly met with aggressive buying from investors who see it as a discount.

The $80,000 level is more than just a round number; it represents a key zone of support and a test of the market’s underlying strength. If buyers step in forcefully at or near this level, it could reinforce the bullish narrative and set the stage for the next leg up. However, a sustained break below could trigger further liquidations and send the price searching for a firmer footing at lower levels.

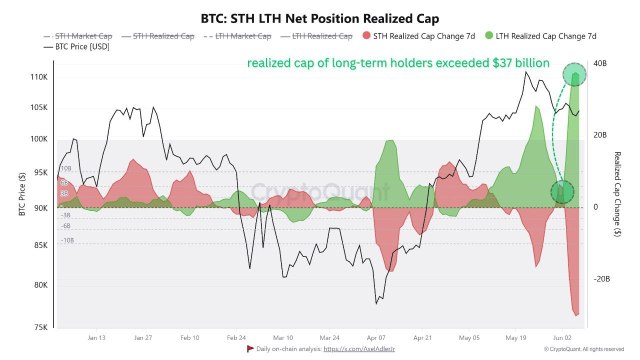

For now, the market is in a tense standoff. The bearish signals from options and ETFs are clear, but the resilience of Bitcoin’s long-term holders and the potential for institutional re-entry on dips remain powerful counter-forces. The battle lines are drawn at $80,000.