A Hawkish Contender for the Fed’s Top Job

The financial world is buzzing with reports that former Federal Reserve Governor Kevin Warsh is set to be nominated by President Trump to lead the central bank. This potential appointment signals a significant shift in the leadership of one of the world’s most powerful financial institutions. Warsh, who served on the Fed’s Board of Governors from 2006 to 2011, is widely viewed as a more hawkish figure, suggesting a potential turn towards tighter monetary policy.

Warsh’s Background and Policy Stance

Kevin Warsh’s tenure at the Fed coincided with the tumultuous period of the 2008 financial crisis, giving him firsthand experience in crisis management. His reputation as a hawk stems from his historical concerns about inflation and his advocacy for a more rules-based approach to monetary policy, potentially moving away from the discretionary measures that have characterized the post-crisis era. Markets are closely watching this development, as his leadership could influence interest rate decisions and the pace of balance sheet normalization for years to come.

An Unexpected Connection to Crypto

Beyond traditional finance, Warsh has previously expressed views that resonate within the cryptocurrency community. In a notable commentary, he suggested that Bitcoin could serve as a “check” on fiscal policy decisions made by governments and central banks. This perspective frames digital assets not just as speculative investments, but as potential disciplinary forces in the global financial system, offering an alternative store of value amidst expansive monetary policies.

While his primary focus would undoubtedly be on the dollar, employment, and inflation, this acknowledgment of Bitcoin’s broader economic role is a unique footnote for a potential Fed Chair. It highlights the growing recognition of cryptocurrency’s impact, even at the highest levels of traditional finance.

What This Means for Markets

The nomination of Kevin Warsh, if confirmed, would mark a new chapter for the Federal Reserve. Investors and analysts are already weighing the implications:

- Monetary Policy: Expectations for interest rate hikes could firm up, affecting bond yields and equity valuations.

- Regulatory Approach: His stance on financial regulation, including for emerging sectors like cryptocurrency, will be scrutinized.

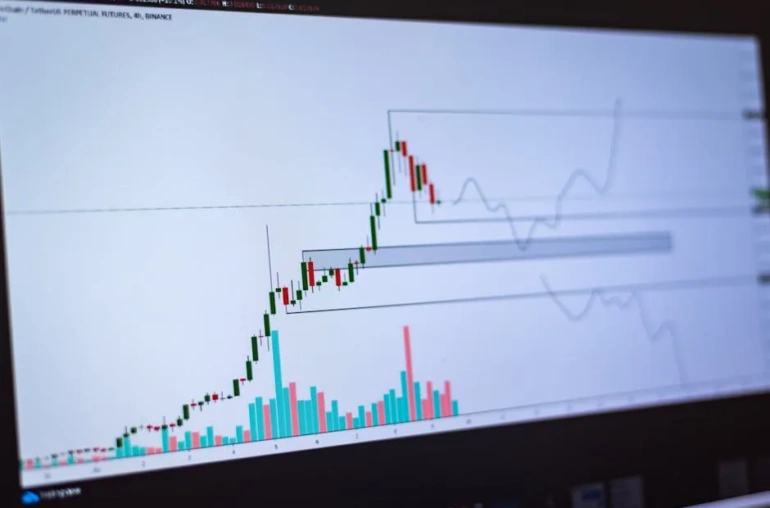

- Market Volatility: The transition and any change in policy communication could lead to near-term volatility in both traditional and digital asset markets.

As the official announcement is anticipated, all eyes are on Washington. The choice of the next Fed Chair will shape the economic landscape, and Kevin Warsh’s potential nomination brings with it a blend of orthodox monetary views and an unconventional recognition of the digital asset revolution.