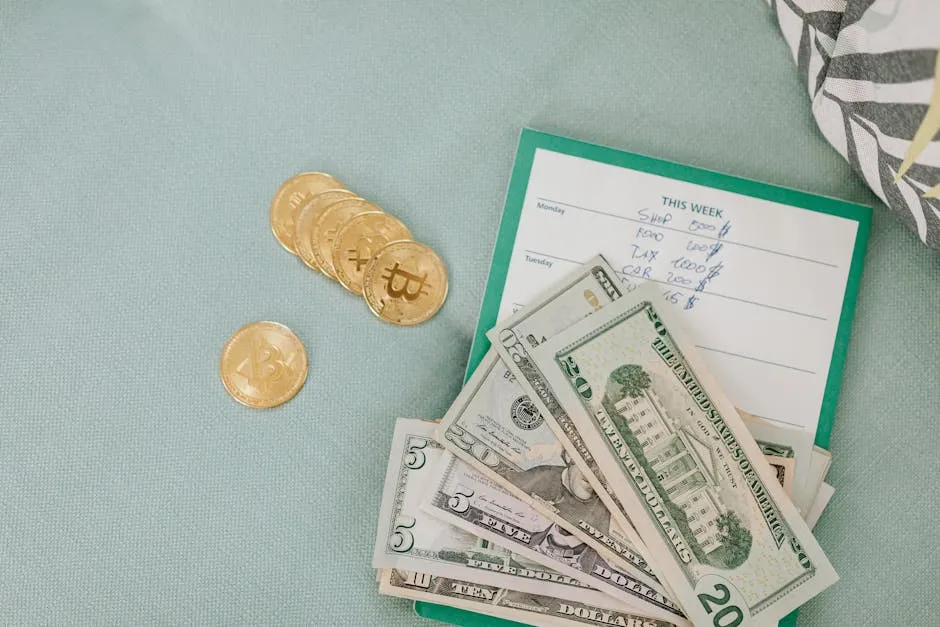

The Real Hurdle for Bitcoin Payments

For years, the conversation around using Bitcoin for everyday purchases has been dominated by discussions about network speed and transaction fees. However, a growing consensus among industry leaders suggests that the primary barrier isn’t technological—it’s regulatory. Specifically, the current tax policy in the United States creates a significant disincentive for people to spend their cryptocurrency.

The Tax Problem: A Disincentive to Spend

Under existing U.S. law, cryptocurrency is treated as property for tax purposes, not as currency. This has a major practical implication: every time you use Bitcoin to buy a cup of coffee or pay for a service, it is considered a taxable event. You must calculate the capital gain or loss based on the difference between the purchase price of the crypto and its fair market value at the time of the transaction.

This creates an administrative nightmare for the average person. The need to track the cost basis for every small transaction and report it to the IRS adds immense complexity and friction. It’s far easier to simply use traditional cash or credit cards, where no such immediate tax liability is triggered by the act of spending.

A Proposed Solution: The De Minimis Exemption

Recognizing this stifling effect on innovation and everyday use, some U.S. lawmakers have proposed a logical fix. Legislation has been introduced to create a de minimis exemption for small cryptocurrency transactions. This exemption would mean that gains from personal transactions under a certain threshold—for example, purchases under $50 or $200—would not be subject to capital gains tax.

Such a policy would mirror how foreign currency transactions are often treated for personal use. The goal is to remove the punitive paperwork burden from minor, everyday purchases, thereby unlocking Bitcoin’s potential as a medium of exchange rather than just a speculative investment asset.

Scaling Tech vs. Regulatory Clarity

While scaling solutions like the Lightning Network continue to improve Bitcoin’s transaction speed and cost-efficiency, their adoption for daily payments is hampered by this foundational tax issue. Why would merchants and consumers go through the hassle of integrating a new payment system if its use automatically generates a tax reporting obligation for the customer?

The path forward requires a two-pronged approach. The technology must continue to evolve to be fast and cheap, but equally important, the regulatory environment must adapt to facilitate, rather than hinder, its use. Clear, sensible tax rules are essential for cryptocurrency to transition from the investment portfolio to the checkout line.

In conclusion, the dream of “buying a coffee with Bitcoin” is being held back more by tax forms than by network latency. For digital currency to achieve its promise as a widespread payment method, regulatory reform is just as critical as technological innovation.