Crypto’s Global Journey: A Patchwork of Progress

The world of cryptocurrency is often discussed as a single, unified revolution. However, a new perspective from one of the world’s largest professional services networks suggests the reality is far more complex. According to a recent report from PricewaterhouseCoopers (PwC), cryptocurrency adoption is not a uniform wave sweeping across the globe. Instead, it is “emerging unevenly across regions,” creating a fragmented and diverse global ecosystem.

A World of Different Challenges

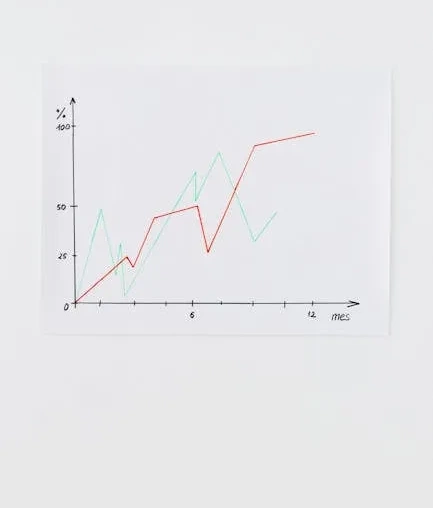

PwC’s analysis highlights that the path to mainstream crypto integration is not a one-size-fits-all journey. Different markets face distinct hurdles and opportunities, leading to vastly different adoption curves. In some regions, the primary challenge might be technological infrastructure or public awareness. In others, the dominant factor is the regulatory environment, which can range from openly supportive to highly restrictive or uncertain.

This fragmentation means that a solution or strategy that works brilliantly in one country could stumble in another. For businesses and investors looking to operate on a global scale, this uneven landscape requires a nuanced and localized approach. Understanding the specific regulatory, economic, and social dynamics of each market becomes crucial.

What Does “Uneven Adoption” Look Like?

We can see this patchwork in action today. Some nations have embraced cryptocurrencies as a tool for financial inclusion, a hedge against inflation, or a novel asset class. Others have taken a cautious stance, prioritizing consumer protection and financial stability, which can slow down integration. A few have implemented outright bans.

This disparity affects everything:

- Regulation: Clear, supportive frameworks in places like the EU with MiCA contrast with evolving and sometimes contradictory rules in larger markets like the United States.

- Institutional Involvement: Major banks and financial institutions are diving into crypto services in some regions while remaining on the sidelines in others due to compliance risks.

- Consumer Use: Adoption for payments, remittances, or savings varies dramatically based on local economic conditions and trust in traditional finance.

Navigating the Fragmented Future

PwC’s report serves as a critical reminder that the future of crypto is not monolithic. For the industry to mature, stakeholders must move beyond a global narrative and develop deep regional expertise. Success will depend on the ability to adapt to local regulations, meet specific market needs, and build trust within distinct cultural contexts.

While this fragmented state presents challenges, it also allows for innovation tailored to local problems. The uneven adoption curve suggests that the crypto ecosystem will continue to evolve in fascinating and unpredictable ways, with different regions potentially becoming leaders in specific applications of blockchain technology. The global story of crypto is, in fact, being written one region at a time.