Introduction

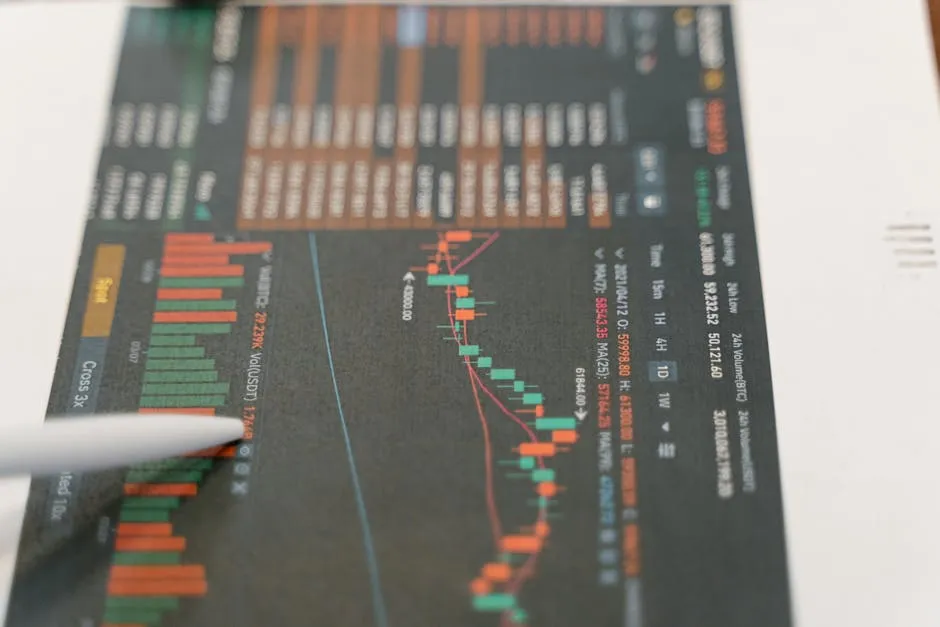

As we delve deeper into the digital age, cryptocurrencies like Bitcoin are increasingly capturing the attention of investors and analysts alike. A recent analysis by VanEck suggests that Bitcoin could play a significant role in global trade and financial systems by 2050, projecting a staggering price of $2.9 million. This article explores the implications of this forecast and what it means for the future of Bitcoin.

Bitcoin’s Potential Role in Global Trade

According to VanEck analysts, Bitcoin has the potential to manage between 5% to 10% of global trade transactions by 2050. This could fundamentally reshape how international commerce is conducted, providing a decentralized alternative to traditional fiat currencies. The appeal of using Bitcoin for trade lies in its ability to facilitate faster and cheaper transactions across borders, reducing the reliance on banks and other intermediaries.

The Case for Bitcoin in Trade

- Speed and Efficiency: Bitcoin transactions can be completed in minutes, regardless of geographic location, compared to traditional banking systems that may take days.

- Lower Fees: Transaction fees for Bitcoin can be significantly lower than those imposed by banks and payment processors.

- Decentralization: By operating outside traditional financial systems, Bitcoin offers a level of autonomy and security that appeals to businesses looking to safeguard their assets.

Central Bank Reserves and Monetary Hedge

VanEck also posits that Bitcoin could represent 2.5% of global central bank reserves by 2050. This transition could mark a pivotal shift in how governments view and utilize cryptocurrencies. As central banks explore digital currencies, Bitcoin may serve as a hedge against economic instability and inflation, providing a store of value that could preserve wealth during turbulent times.

Strategic Implications for Investors

For investors, the projections made by VanEck emphasize the importance of considering Bitcoin as a long-term investment. If Bitcoin can indeed capture a significant share of global trade and central bank reserves, its value could skyrocket, making it an attractive option for those looking to diversify their portfolios.

Challenges Ahead

Despite the optimistic projections, several challenges remain for Bitcoin’s widespread adoption. Regulatory hurdles, technological limitations, and market volatility are significant obstacles that need to be addressed. Furthermore, as Bitcoin becomes a more integral part of the financial ecosystem, its price could be influenced by a variety of factors, including government regulations and competition from other cryptocurrencies.

Conclusion

In summary, VanEck’s forecast of Bitcoin reaching $2.9 million by 2050 is a bold and promising outlook for the cryptocurrency. As it positions itself to play a crucial role in global trade and central bank reserves, Bitcoin may redefine our understanding of value and currency. For investors and businesses alike, this is a space to watch closely as the future of finance continues to evolve.