Will 2026 Be the Year Crypto Catches Up to Gold and Stocks?

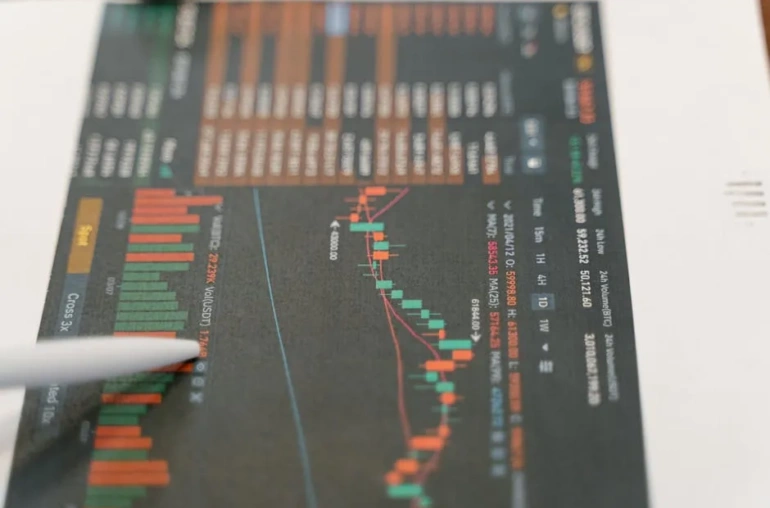

As we assess the current financial landscape, it’s clear that cryptocurrencies have faced significant challenges compared to traditional assets like gold and stocks. Since the beginning of November, gold has surged by 9%, the S&P 500 has seen a modest gain of 1%, while Bitcoin has experienced a staggering decline of 20%. This disparity raises an intriguing question: can cryptocurrencies, particularly Bitcoin, close the gap by 2026?

The Current Market Snapshot

The recent performance of major assets has highlighted the volatility and unpredictability that cryptocurrencies are known for. Gold, often perceived as a safe haven during economic uncertainty, has shown robust growth, reflecting investors’ flight to stability. Conversely, the S&P 500’s slight uptick suggests a level of resilience in the stock market, although it pales in comparison to gold’s impressive gains.

Bitcoin’s 20% drop during this period indicates a stark contrast to these more stable investments. This decline has led many to question the future viability of cryptocurrencies as a preferred asset class, especially when compared to the consistent performance of gold and other equities.

Looking Ahead: The 2026 Potential

Despite the current lag, there are growing discussions among analysts and investors about the potential for a crypto resurgence by 2026. Several factors could contribute to a favorable shift in the market:

- Increased Adoption: As more businesses and financial institutions embrace cryptocurrencies, we could see a significant uptick in demand, potentially driving prices higher.

- Technological Advancements: Continued innovation in blockchain technology may enhance the functionality and security of cryptocurrencies, making them more appealing to a broader audience.

- Regulatory Clarity: Improved regulations could instill greater confidence among investors, attracting capital back into the crypto market.

- Market Cycles: Historically, markets operate in cycles. It’s possible that Bitcoin and other cryptocurrencies may experience a rally as investors look for high-growth opportunities.

Conclusion

While 2023 has not been kind to cryptocurrencies, the potential for a turnaround by 2026 is something that investors should keep on their radar. The gap between crypto, gold, and stocks may narrow as the market evolves, but it will depend heavily on external economic factors, investor sentiment, and technological developments. For now, staying informed and prepared for shifts in the market landscape is crucial for anyone involved in the financial sector.

As we move forward, it will be fascinating to watch how these dynamics unfold, and whether cryptocurrencies can reclaim their place in the investment world alongside traditional assets like gold and stocks.