Bitcoin Holders Pause Selloff as Ether Whales Increase Their Investments

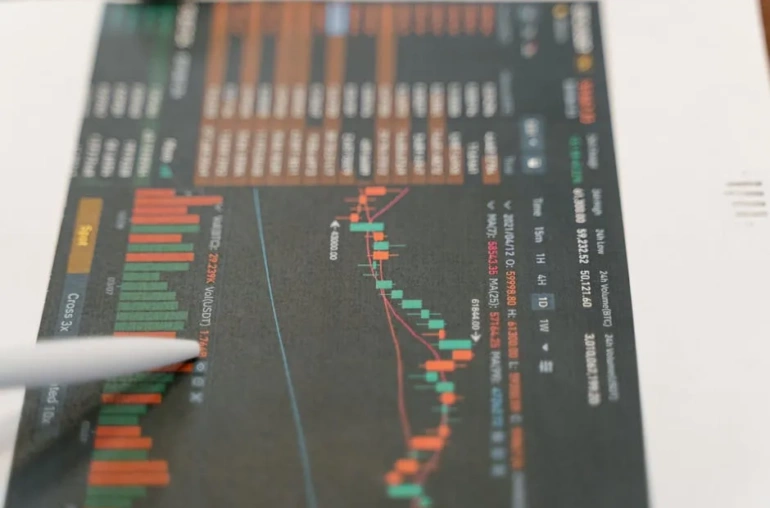

In the ever-shifting landscape of cryptocurrency, notable trends are emerging among Bitcoin and Ethereum investors. Recent data indicates that long-term Bitcoin holders, commonly referred to as “hodlers,” have ceased their selling activities. Meanwhile, Ether whales are ramping up their accumulation of Ethereum. Despite these significant movements, the market continues to exhibit bearish tendencies.

The Situation with Bitcoin Hodlers

For quite some time, long-term Bitcoin holders have been under pressure to sell. However, this trend is finally showing signs of a reversal. The selling pressure that has plagued Bitcoin’s market dynamics is now abating, suggesting that these investors are either holding firm or reinvesting their funds rather than exiting the market.

This change is crucial for Bitcoin’s price stability. When hodlers decide to sell, it often leads to increased volatility and downward pressure on prices. Conversely, their willingness to hold could indicate confidence in Bitcoin’s long-term potential, which may help bolster its value in the coming months.

Ether Whales on the Move

On the flip side, we have Ether whales who are making significant investments in Ethereum. These large holders of Ether are seen as an influential force in the market, and their decision to accumulate more of this cryptocurrency could signal optimism about its future performance.

Whales often have the ability to impact market prices due to the sheer volume of their trades. As they increase their holdings, it may create a perception of scarcity, leading other investors to follow suit. This behavior can foster a more bullish outlook for Ethereum and potentially create upward momentum for its price.

Current Market Outlook

Despite the positive signs emerging from Bitcoin hodlers and Ether whales, the broader market remains bearish. The ongoing uncertainty across financial markets, coupled with macroeconomic factors, continues to weigh on investor sentiment. Many are cautious about entering or increasing their positions in cryptocurrencies, which can hinder significant price recoveries.

However, the actions of long-term Bitcoin holders and Ether whales are noteworthy. They reflect a divergence in strategies among investors. While some may be looking to exit the market, others see the current conditions as a buying opportunity, indicating a potential shift in market dynamics.

What This Means for Investors

As these trends develop, it’s essential for investors to stay informed and consider their strategies carefully. For Bitcoin holders, the decision to hold rather than sell could be a sign of confidence in the asset’s long-term value. For those involved with Ethereum, the accumulation by whales may present a compelling narrative for its future growth.

In conclusion, while the market sentiment remains cautious, the behaviors of long-term hodlers and Ether whales could play a pivotal role in shaping the next phase of the cryptocurrency landscape. As always, investors should conduct thorough research and remain vigilant in these unpredictable markets.