The Challenges Facing Bitcoin Miners in Today’s Market Landscape

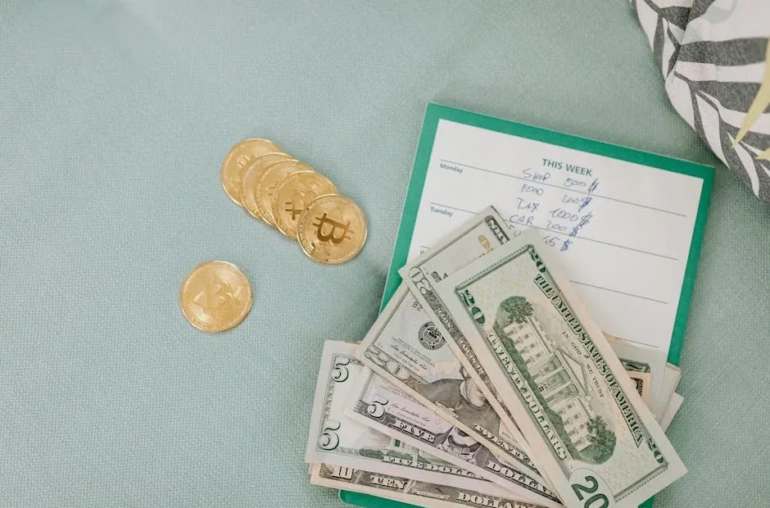

In recent months, Bitcoin miners have found themselves grappling with an unprecedented economic environment. With mining revenues plummeting to structural lows, the industry is facing what many experts are calling the ‘harshest margin environment of all time.’ This situation is characterized by a significant drop in hashprice, rising operational costs, and extended payback periods that now stretch past 1,000 days, putting immense pressure on even the most established operators in the field.

Understanding Hashprice and Its Impact

Hashprice, which reflects the revenue generated per unit of computational power used in Bitcoin mining, has seen a steep decline. This downturn signifies that miners are earning significantly less for their efforts, making it increasingly difficult to cover operational costs. As mining equipment consumes vast amounts of electricity and requires continuous maintenance, the financial strain is becoming increasingly unsustainable.

Rising Costs and Lengthening Payback Periods

In addition to dwindling revenues, the costs associated with Bitcoin mining are on the rise. Factors such as the price of electricity, hardware, and cooling solutions have all contributed to escalating operational expenses. Miners are now facing payback periods that exceed 1,000 days, meaning it takes more than two and a half years to recoup their investment in mining equipment and infrastructure. Such lengthy payback periods create a challenging scenario for those looking to enter or sustain a presence in the Bitcoin mining space.

The Impact on Mining Operations

The combination of falling hashprices and rising costs has forced many mining operations to reevaluate their strategies. Smaller miners, in particular, are feeling the pinch, as they lack the resources to withstand prolonged periods of low profitability. Larger operators, while better positioned to absorb some of the financial blow, are also feeling the pressure as they aim to maintain their competitive edge in a tightening market.

What Lies Ahead for Bitcoin Miners?

As the Bitcoin market continues to evolve, miners will need to adapt to survive. This may involve investing in more energy-efficient technologies, diversifying revenue streams, or even reconsidering the locations of their operations to capitalize on cheaper energy sources. The future of Bitcoin mining is uncertain, but resilience and innovation will be key for those hoping to navigate through these turbulent waters.

In conclusion, the current environment presents significant challenges for Bitcoin miners. With structural lows in revenue and prolonged payback periods, the industry faces a critical juncture that will test the adaptability of its players. Only time will tell how the landscape will change, but one thing is clear: the road ahead is fraught with challenges that demand strategic foresight and operational efficiency.