Bitcoin’s Surge to $114K: A Sign of Renewed Confidence Among Futures Traders

The cryptocurrency market is buzzing with excitement as Bitcoin recently soared to an impressive $114,000. This remarkable rally not only signifies a potential shift in market dynamics but also highlights the growing confidence among crypto futures traders. With Bitcoin, alongside altcoins like SOL and ETH, breaking through key resistance levels, many are starting to rethink their strategies in this ever-evolving space.

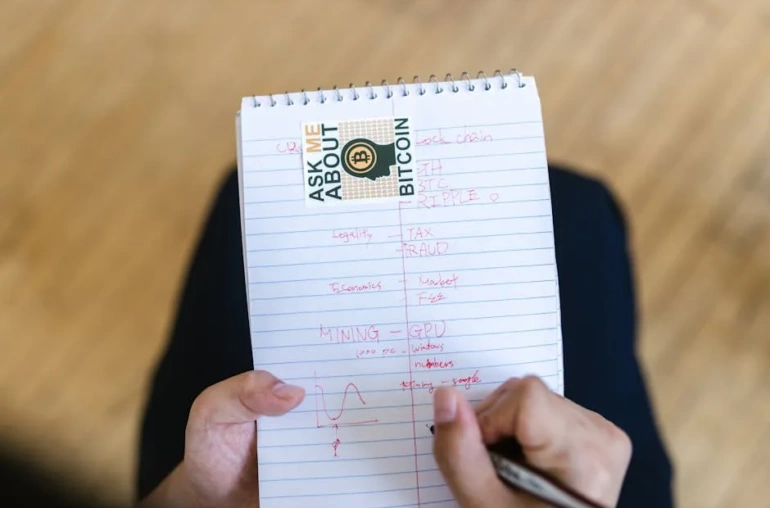

The Resurgence of Futures Trading

As Bitcoin’s price continues to climb, futures traders are making a notable comeback. This resurgence is evident in the increasing number of fresh positions being opened across various exchanges. Traders are recognizing the potential for profit amid the current bullish trend, choosing to capitalize on Bitcoin’s upward momentum.

The futures market allows traders to speculate on the future price of cryptocurrencies without having to own the underlying asset directly. This flexibility has attracted a diverse range of investors, from institutions to individual retail traders, all eager to participate in the opportunities presented by the volatile market.

Market Reaction and Implications

The rally in Bitcoin’s price has not only invigorated futures traders but has also had a ripple effect on the broader cryptocurrency market. Altcoins such as SOL and Ethereum (ETH) have also experienced significant gains, benefiting from the positive sentiment surrounding Bitcoin. This interconnectedness highlights the importance of Bitcoin as a market leader in the crypto space.

- Bitcoin: The primary driver of market confidence, its surge to $114K has sparked interest in futures trading.

- SOL and ETH: These altcoins have followed Bitcoin’s lead, with many traders diversifying their positions across multiple assets.

What Lies Ahead?

While the current rally is promising, it is essential to approach the market with caution. Traders and investors should remain vigilant, as the cryptocurrency landscape is known for its sudden shifts and volatility. Understanding market trends, utilizing risk management strategies, and staying informed about global economic factors will be crucial for navigating these turbulent waters.

In conclusion, the rise of Bitcoin to $114K marks a pivotal moment for the futures trading community, demonstrating renewed confidence and enthusiasm in the market. As traders continue to explore new opportunities, the importance of informed decision-making and strategic planning cannot be overstated. The road ahead may be unpredictable, but for now, the future looks bright for those willing to engage in this dynamic environment.