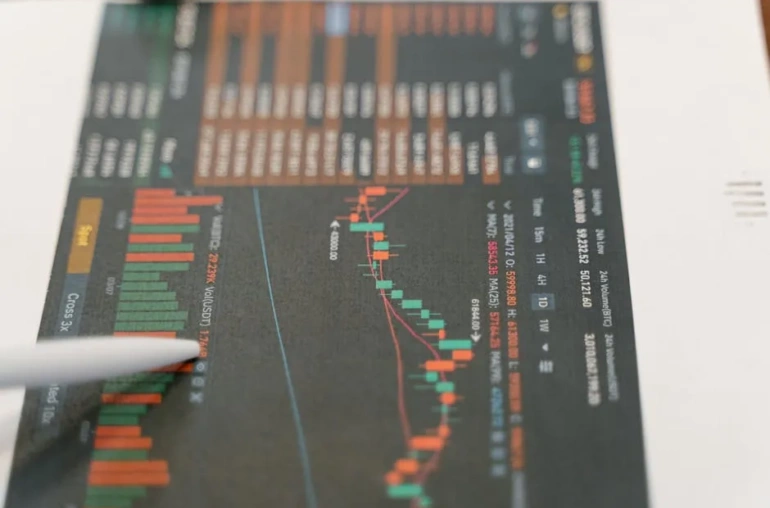

The Milestone of $4,000: Gold’s New High

In a significant development for the financial markets, gold futures have recently reached the unprecedented level of $4,000 per ounce. This milestone illustrates a growing demand for safe-haven assets, as investors seek stability amid economic uncertainties. With gold often viewed as a hedge against inflation and market volatility, its ascent raises questions about the implications for other assets, particularly Bitcoin.

Gold’s Role as a Safe-Haven Asset

Gold has long been regarded as a reliable store of value during turbulent times. Its ability to retain value when other investments falter makes it a popular choice among investors looking to protect their wealth. The recent surge in gold prices can be attributed to various factors, including geopolitical tensions, inflation fears, and a general decline in consumer confidence in traditional financial systems.

Bitcoin: The Digital Gold?

As gold reaches new heights, many analysts are drawing parallels between this precious metal and Bitcoin, often referred to as “digital gold.” Just like gold, Bitcoin is limited in supply, which contributes to its value proposition. With a cap of 21 million coins, Bitcoin’s scarcity could drive its price upward, especially if it continues to gain acceptance as a legitimate form of currency and investment.

Market Predictions: Bitcoin Following Gold’s Lead

Analysts predict that Bitcoin’s price could follow suit as gold’s value climbs. The reasoning is straightforward: as investors flock to safe-haven assets, the appetite for Bitcoin may also increase. The cryptocurrency has already shown resilience in times of economic distress, and its growing institutional adoption could further bolster its status as a digital alternative to gold.

Factors Influencing Bitcoin’s Growth

- Institutional Interest: More institutional investors are recognizing Bitcoin’s potential, leading to increased demand and market stability.

- Inflation Hedge: With rising inflation rates globally, Bitcoin is being viewed as a hedge against the eroding purchasing power of fiat currencies.

- Technological Advancements: Improvements in blockchain technology and regulatory clarity could pave the way for broader adoption of Bitcoin.

Conclusion: The Interplay Between Gold and Bitcoin

The striking rise of gold to $4,000 per ounce serves as a reminder of the importance of safe-haven assets during uncertain times. As investors reassess their portfolios, Bitcoin’s potential to mirror gold’s performance cannot be overlooked. The cryptocurrency market has shown that it can thrive even in challenging economic climates, making it a compelling option for diversification.

As the financial landscape continues to evolve, both gold and Bitcoin will likely play critical roles in shaping investment strategies. Time will tell how closely Bitcoin will track gold’s trajectory, but one thing is clear: the interest in digital assets is only set to grow.