Understanding the Risks of Tokenizing Stocks

As the cryptocurrency landscape continues to evolve, one of the latest trends is the tokenization of company shares. While this innovative approach offers promising opportunities for liquidity and accessibility, it also introduces a host of new risks for investors. Crypto treasury companies, already familiar with the volatility of digital assets, are at the forefront of this movement, but they are also warning investors to tread carefully.

What is Tokenization?

Tokenization refers to the process of converting ownership of real-world assets, such as stocks, into digital tokens that can be traded on blockchain platforms. Each token represents a share of the asset, allowing for fractional ownership and potentially broadening the investor base. This method can enhance liquidity, making it easier for investors to buy and sell shares without traditional market constraints.

The Appeal of Tokenized Stocks

The appeal of tokenizing stocks lies in its ability to democratize access to investment opportunities. With tokenization, even small investors can own a fraction of high-value assets, which was previously unattainable. Moreover, transactions can occur 24/7 on blockchain platforms, eliminating the delays associated with traditional trading hours.

Investor Warnings from Crypto Executives

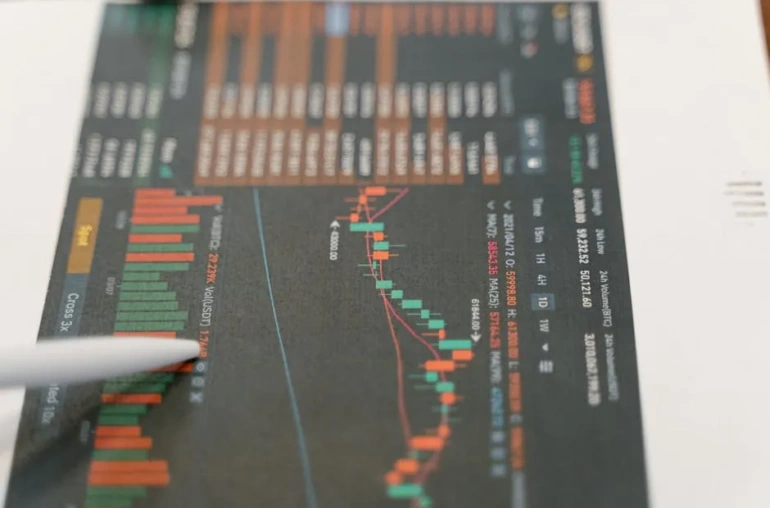

Despite the advantages, leading figures in the crypto industry are cautioning investors about the inherent risks. The volatility associated with digital assets can be magnified when applied to tokenized stocks. For instance, the price fluctuations of cryptocurrencies can lead to unpredictable market behavior, which could adversely affect tokenized shares.

Furthermore, the regulatory landscape surrounding tokenized assets is still developing. This uncertainty can expose investors to additional risks, such as potential legal challenges or changes in regulations that could impact the value and legitimacy of tokenized stocks.

Challenges in the Tokenization Process

Tokenizing stocks also presents several technical challenges. The process requires robust infrastructure to ensure security and transparency. If a platform is not adequately secured, investors may risk losing their assets to hacks or fraud. Moreover, the back-end processes of trading and managing these tokens need to be streamlined to prevent inefficiencies that could deter investors.

Conclusion: A Cautious Approach is Essential

As the trend of tokenizing stocks gains momentum, investors must remain vigilant and informed. While the potential for innovation and increased access to markets is significant, the associated risks cannot be overlooked. Engaging with trusted platforms, conducting thorough research, and understanding the market dynamics will be vital for those considering investments in tokenized shares. In this rapidly changing landscape, a cautious and informed approach will serve investors best.