Institutional Demand Surges: Bitcoin and Ethereum ETFs See Major Inflows

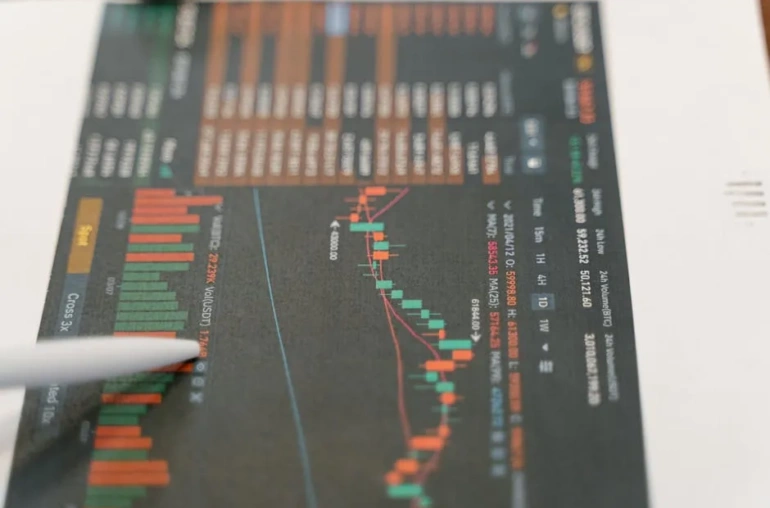

In a noteworthy development for the cryptocurrency market, spot Bitcoin ETFs have attracted a staggering $642 million in investments, while Ether ETFs have seen an influx of $405 million as of last Friday. This surge in capital reflects a growing confidence among institutional investors in the cryptocurrency space.

The Rise of Bitcoin and Ethereum ETFs

Exchange-Traded Funds (ETFs) have become a popular way for investors to gain exposure to cryptocurrencies without directly purchasing the underlying assets. Bitcoin and Ethereum ETFs, in particular, have garnered significant attention due to their potential for high returns and the increasing acceptance of cryptocurrencies in mainstream finance.

This recent influx of funds into Bitcoin and Ethereum ETFs indicates a shift in market sentiment. Institutional investors, who were previously hesitant to dive into the volatile world of cryptocurrencies, are now recognizing the potential benefits. Factors contributing to this renewed interest include the maturation of the crypto market, regulatory advancements, and a growing understanding of blockchain technology.

What This Means for the Market

The significant investments in Bitcoin and Ethereum ETFs could have several implications for the broader cryptocurrency market:

- Increased Legitimacy: As more institutional money flows into cryptocurrencies, the market may gain further legitimacy in the eyes of traditional investors. This could lead to increased participation from both retail and institutional investors alike.

- Price Stability: The influx of capital from institutions may contribute to greater price stability in the market, which has historically been plagued by volatility. A more stable market could attract additional investors looking for a safer entry point.

- Innovation and Development: With increased investment, companies and projects within the crypto ecosystem may receive the funding necessary to drive innovation and development. This could lead to the creation of new financial products and services that further enhance the market’s appeal.

Looking Ahead

As institutional confidence in Bitcoin and Ethereum continues to rise, it will be interesting to see how these trends evolve. Will we see even greater inflows into ETFs? How will this impact the overall cryptocurrency landscape?

Investors should remain vigilant and keep an eye on market developments. The rising interest in Bitcoin and Ethereum ETFs is a clear signal that cryptocurrencies are increasingly being viewed as a viable investment option. As the market matures, the potential for significant growth remains, making it an exciting time for both seasoned investors and newcomers alike.

In conclusion, the $642 million and $405 million inflows into Bitcoin and Ethereum ETFs respectively highlight a pivotal moment in the cryptocurrency market, showcasing a shift towards greater institutional confidence and potential stability. The future seems bright for cryptocurrencies as they continue to attract significant institutional interest.