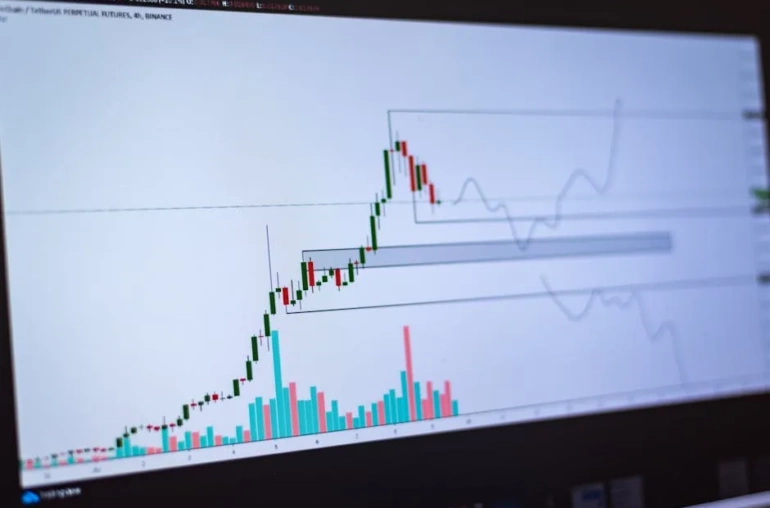

Bitcoin Open Interest Hits Record $44B as Prices Dip Below $116K

On Thursday, Bitcoin (BTC) experienced a notable drop, falling to $115,002, which marked a decline of over 6% from its record peak of July 14. This significant price movement comes at a time when open interest in Bitcoin futures has surged to an all-time high of $44.5 billion. The recent fluctuations in Bitcoin’s price have raised eyebrows in the trading community, as many traders continue to open new positions despite the downturn.

Understanding Open Interest

Open interest refers to the total number of outstanding derivative contracts, such as futures and options, that have not been settled. It serves as an indicator of market activity and liquidity. A rising open interest typically suggests that new money is entering the market, while a decrease may indicate that the market is losing interest.

The record open interest of $44.5 billion reflects a robust level of trading activity in the Bitcoin market. This increase suggests that traders are actively seeking to capitalize on Bitcoin’s price movements, even amid the current dip. Such enthusiasm can be interpreted in various ways, and understanding the implications of open interest is crucial for both traders and investors.

What Does This Mean for Bitcoin Traders?

For Bitcoin traders, the rise in open interest amidst falling prices can present both opportunities and risks. On one hand, the influx of new positions indicates a bullish sentiment among some traders who believe that Bitcoin’s current price does not reflect its long-term value. On the other hand, it raises concerns about potential market volatility as traders react to price changes.

As Bitcoin continues to fluctuate, traders must remain vigilant and consider various factors that could impact market dynamics. The interplay between open interest and price movements can often provide insights into market sentiment and potential future trends.

Looking Ahead

The cryptocurrency market is known for its volatility, and recent events are a reminder of how quickly conditions can change. As Bitcoin hovers around the $115,000 mark, market participants will be closely watching open interest levels and trading volumes to gauge the next moves in this dynamic landscape.

While some traders may see the current dip as a buying opportunity, others may opt for caution, weighing the risks of further price declines. Ultimately, the relationship between Bitcoin’s price and open interest will play a critical role in shaping market sentiment in the coming weeks.

In summary, Bitcoin’s open interest reaching an all-time high of $44.5 billion amid a price drop signifies a complex scenario for traders. As the market evolves, staying informed and adaptable will be key for anyone involved in cryptocurrency trading.