The $60B Wake-Up Call: Why Crypto Payment Solutions Are Gaining Momentum

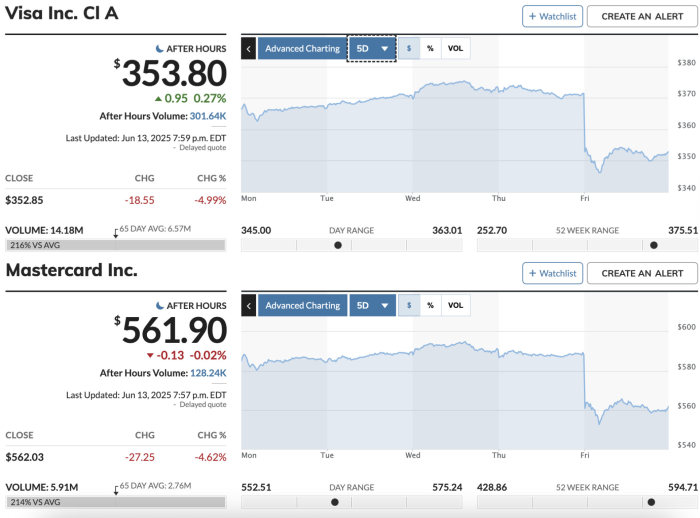

Visa and Mastercard’s recent $60 billion stock plunge isn’t just a blip—it’s a symptom of a shifting financial landscape. As merchants and consumers grow weary of traditional payment rails’ fees and centralized control, these 5 altcoins are emerging as viable alternatives for the next era of transactions.

Why Crypto Payments Are the Future

The cracks in legacy systems are showing:

- Fee fatigue: Average credit card processing fees range 1.5%-3.5%, cutting into slim profit margins

- Centralization risks: Single points of failure (like 2024’s Visa Europe outage) disrupt global commerce

- Cross-border friction: Traditional transfers take days and cost up to 10% in remittance corridors

Top 5 Contenders to Watch

1. Solana (SOL) – The Speed Demon

With 2,700+ TPS and sub-$0.01 transaction fees, Solana’s blockchain is built for high-volume payments. Major integrations with Stripe and Shopify prove its merchant-ready potential.

2. Ripple (XRP) – The Banking Challenger

Already partnered with 100+ financial institutions, XRP settles cross-border payments in 3-5 seconds at a fraction of SWIFT’s cost. The SEC lawsuit resolution could trigger mass adoption.

3. Stellar (XLM) – The Remittance Revolution

Designed for financial inclusion, Stellar’s network processes 5M+ daily transactions. Its USDC integration makes it ideal for stablecoin-based payments.

4. Avalanche (AVAX) – The Enterprise Pick

With sub-second finality and custom blockchain solutions, Avalanche is winning over Fortune 500 companies exploring crypto payments.

5. Hedera (HBAR) – The Regulatory-Friendly Option

Governed by councils including Google and IBM, Hedera’s aBFT consensus offers Visa-level throughput (10,000+ TPS) with carbon-negative operations.

The Road Ahead

While crypto payments currently represent just 0.5% of global transaction volume, Juniper Research predicts 380% growth by 2027. As Layer-2 solutions mature and regulatory clarity improves, these altcoins could redefine how value moves worldwide.

Key takeaway: The payment giants’ stumble creates an opening—watch for merchant adoption spikes and infrastructure partnerships as signals of which crypto will lead the charge.