Ethereum Whale Sees Opportunity in Market Panic

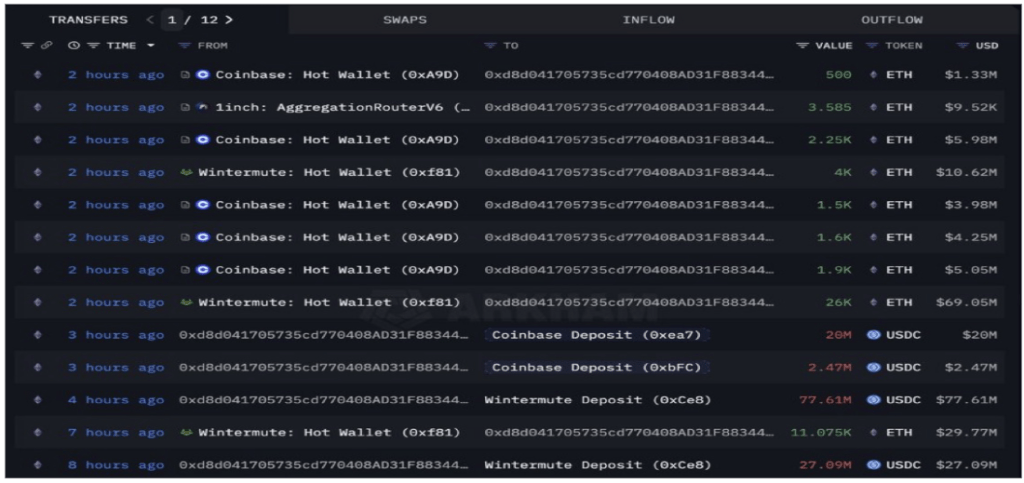

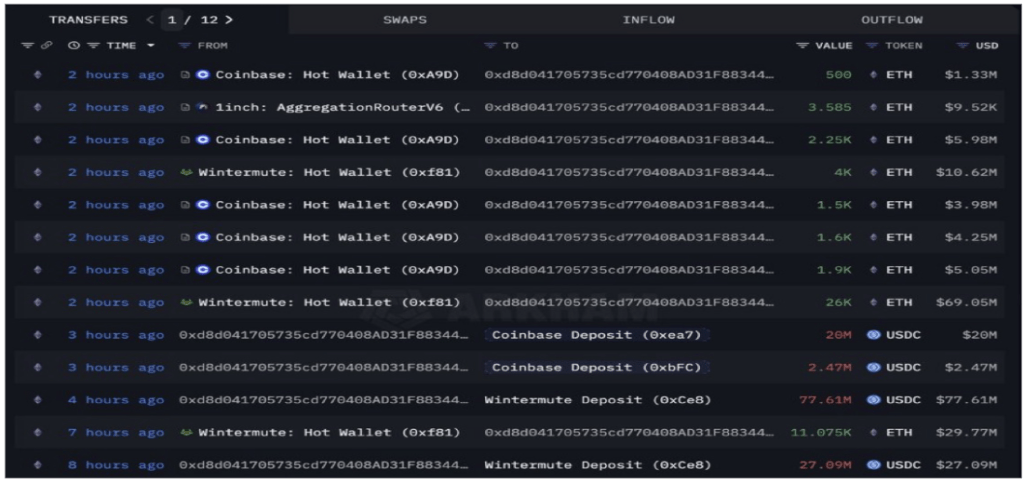

While most investors were scrambling to sell during the recent crypto market crash, one deep-pocketed Ethereum whale saw a golden opportunity. Blockchain analytics platform Lookonchain reports that this unidentified investor purchased a jaw-dropping $127 million worth of ETH amid the downturn, signaling strong confidence in Ethereum’s long-term potential.

Whale vs. Retail: A Tale of Two Strategies

The whale’s massive accumulation stands in stark contrast to the panic selling observed among retail traders. This divergence highlights a classic market dynamic:

- Retail traders often react emotionally to price drops, selling at lows

- Institutional players frequently use downturns to accumulate assets at discounted prices

- Market cycles tend to reward those who maintain conviction during fear periods

What This Whale Move Tells Us

The $127 million purchase suggests several key insights about current market conditions:

- Valuation opportunity: The whale likely sees ETH as undervalued at current prices

- Long-term bullishness: Such a large position indicates expectations of future price appreciation

- Market sentiment indicator: Whale accumulation often precedes price recoveries

Historical Context of Whale Accumulation

This isn’t the first time major investors have made bold moves during market turmoil:

| Date | Event | Outcome |

|---|---|---|

| June 2022 | Whales bought $90M ETH during Terra collapse | ETH rallied 85% in following 6 months |

| March 2020 | Institutional accumulation during COVID crash | Preceded 2021 bull market |

Should Retail Investors Follow the Whale?

While whale activity can be informative, experts caution against blindly following large investors:

- Whales have different risk profiles and time horizons

- Their entry prices may be substantially lower than current levels

- Proper position sizing is crucial for retail portfolios

The key takeaway? Smart money sees value in Ethereum at current levels, but every investor should conduct their own research and risk assessment before making decisions.

As the market digests this whale activity, all eyes will be on whether this accumulation marks a potential turning point for Ethereum’s price action.