Bitcoin’s Resilience Amid Market Volatility

Despite recent geopolitical tensions causing a temporary slump in Bitcoin’s price, the cryptocurrency has shown remarkable resilience, holding steady in the mid-$100,000 range. Market sentiment remains cautiously optimistic, with analysts pointing to key on-chain metrics—like the Puell Multiple—as evidence that this rally may still have plenty of fuel left.

What Is the Puell Multiple?

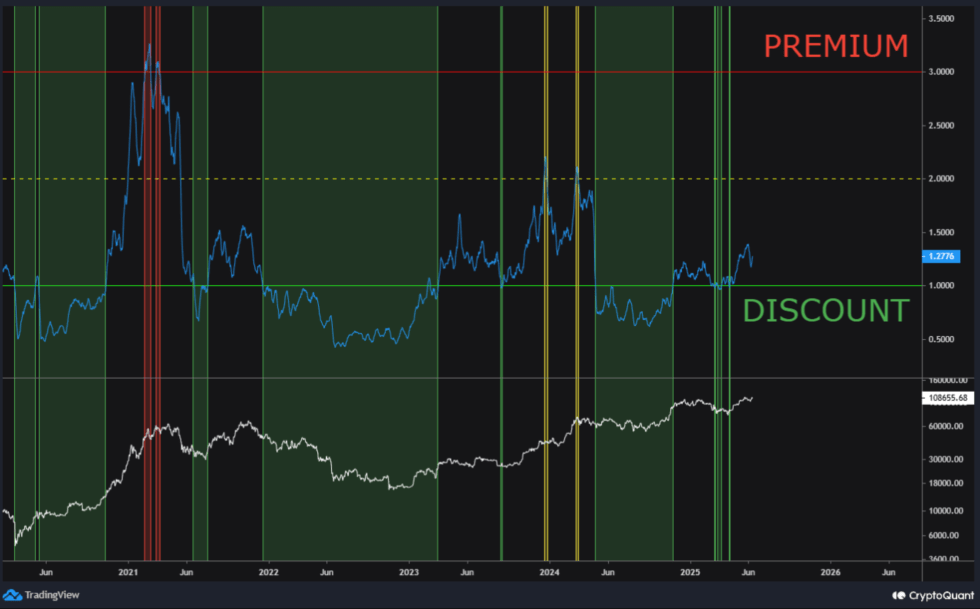

The Puell Multiple is a powerful on-chain indicator that measures the ratio of Bitcoin’s daily issuance value (miner revenue) to its 365-day moving average. Historically, it has been a reliable tool for identifying market cycles:

- Low values (below 0.5) often signal undervaluation and accumulation phases.

- High values (above 4) indicate overvaluation and potential market tops.

Currently, the Puell Multiple sits in a “neutral” zone, suggesting that Bitcoin’s price surge hasn’t yet reached euphoric levels—a bullish sign for further upside.

Why This Rally Isn’t Over

Unlike past cycles where extreme greed dominated, the current market lacks the frothy sentiment typical of a peak. Key factors supporting continued growth include:

- Institutional demand: Spot Bitcoin ETFs and corporate adoption are driving sustained buying pressure.

- Miners’ discipline: Reduced selling pressure as miners hold reserves post-halving.

- Macro tailwinds: Weakening dollar and potential Fed rate cuts could boost crypto markets.

Historical Context Matters

In 2017 and 2021, Bitcoin’s price peaked when the Puell Multiple crossed into “overheated” territory. Today’s readings mirror early-stage bull markets, hinting at a longer runway. As Glassnode notes, “The absence of miner capitulation and balanced profit-taking suggest organic growth.”

What Traders Should Watch

While the Puell Multiple is encouraging, prudent investors should monitor:

- Exchange reserves: Declining balances signal reduced selling pressure.

- Miner flows: Spikes in miner-to-exchange transfers may precede corrections.

- Macro risks: Geopolitical events or regulatory shifts could trigger volatility.

Bottom Line: Bitcoin’s rally appears far from exhausted. With the Puell Multiple and other metrics flashing green, the path to new all-time highs remains open—but staying alert to on-chain and macroeconomic cues is crucial.