Bitcoin Long-Term Investors Double Down Despite Geopolitical Chaos

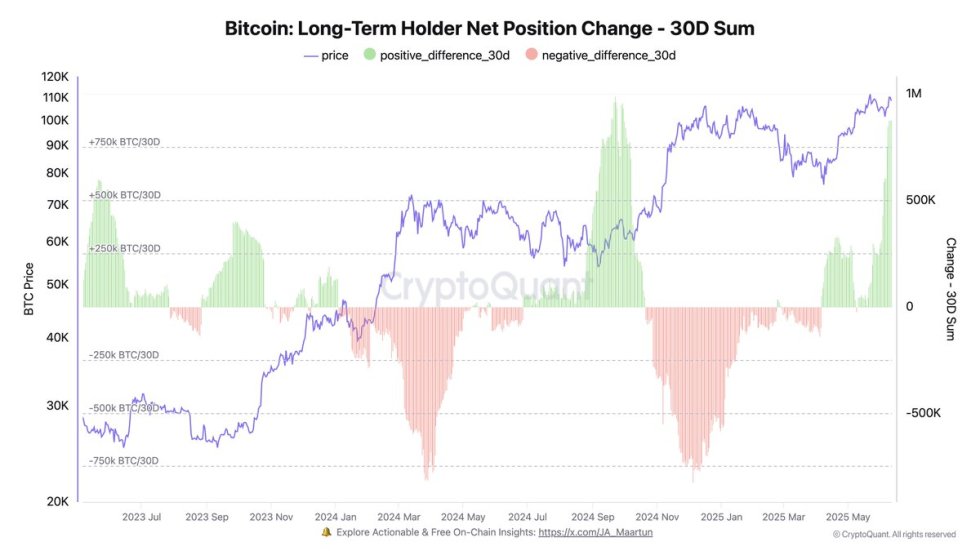

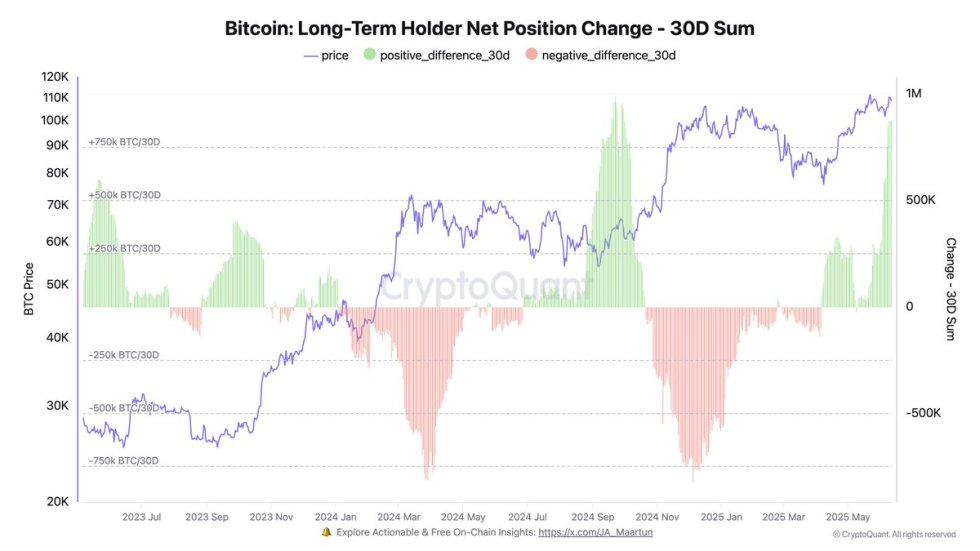

In a striking display of conviction, Bitcoin’s long-term holders (LTHs) accumulated over 880,000 BTC in just 30 days, even as geopolitical tensions sent shockwaves through global markets. This surge in accumulation highlights a growing divide between short-term panic sellers and investors with a steadfast belief in Bitcoin’s long-term value proposition.

Market Turbulence vs. Holder Resilience

Earlier this week, reports of escalating Middle East tensions triggered a risk-off sentiment across equities and crypto markets. Bitcoin briefly dipped below key support levels, while traditional safe-haven assets like gold and oil rallied. Yet, data reveals that long-term holders—entities holding BTC for at least 155 days—continued accumulating at an accelerated pace.

This behavior underscores a critical trend: seasoned Bitcoin investors are treating price dips as buying opportunities rather than exit signals. Analysts suggest this reflects:

- Strong belief in Bitcoin’s scarcity: With the halving reducing new supply, LTHs are positioning for future demand surges.

- Institutional groundwork: ETF approvals and corporate adoption (e.g., MicroStrategy’s ongoing purchases) validate Bitcoin’s store-of-value narrative.

- Macro hedging: Amid inflation concerns and currency debasement risks, BTC is increasingly seen as a hedge.

The Data Behind the Accumulation Spike

On-chain metrics paint a clear picture of holder behavior:

- LTH supply hit a 6-month high, now controlling ~75% of circulating BTC.

- Exchange reserves dropped to 5-year lows, signaling reduced selling pressure.

- Realized cap (a measure of investor cost basis) stabilized, suggesting most holders remain profitable.

What This Means for Bitcoin’s Future

While short-term volatility may persist due to macroeconomic uncertainty, the actions of long-term holders offer a bullish counter-narrative. Their growing dominance reduces liquid supply, potentially amplifying upward price moves when demand returns. As one analyst noted: “When weak hands sell to strong hands, the market emerges healthier.”

For investors, the key takeaway is clear: Bitcoin’s foundational thesis remains intact, and those with multi-year horizons are betting big on its scarcity-driven appreciation. The next major rally could be fueled by this very accumulation phase.