Dogecoin’s Price Rebounds – But Where’s the Volume?

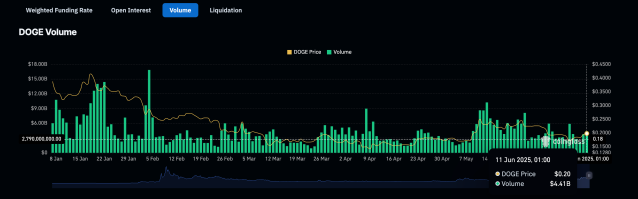

Dogecoin (DOGE) has recently seen a modest price rebound, climbing over 5% as Bitcoin surged past $110,000 and Ethereum jumped 10% in a single day. While this upward movement might seem promising for DOGE holders, a deeper look reveals a concerning trend: trading volume remains unusually low. This divergence between price and volume raises questions about the sustainability of Dogecoin’s rally.

What Does Low Volume Mean for Dogecoin?

In trading, volume is a critical indicator of market conviction. When prices rise without a corresponding increase in volume, it often suggests weak buyer interest or a lack of broader market participation. For Dogecoin, this could mean:

- Limited Momentum: The rally may be driven by a small group of traders rather than widespread demand.

- Risk of Reversal: Low-volume rallies are prone to sharp pullbacks if selling pressure emerges.

- Whale Influence: A few large holders (whales) could be propping up the price temporarily.

Why Isn’t DOGE Volume Keeping Up?

Several factors could explain Dogecoin’s sluggish trading activity:

- Shift in Trader Focus: Investors may be prioritizing Bitcoin and Ethereum amid their bullish runs.

- Meme Coin Fatigue: The hype around meme coins like DOGE may be waning compared to utility-driven altcoins.

- Regulatory Uncertainty: Broader crypto market hesitancy could be dampening speculative trading.

Should Traders Be Worried?

While Dogecoin’s rebound is encouraging, the low volume suggests caution. Historically, assets that rally on thin volume struggle to maintain upward momentum. For DOGE to sustain its gains, it needs:

- A surge in trading activity to confirm buyer interest.

- Catalysts like Elon Musk’s endorsements or new exchange listings.

- Broader altcoin market strength to lift sentiment.

The Bottom Line

Dogecoin’s price rebound is a positive sign, but the lack of volume casts doubt on its staying power. Traders should watch for increasing volume to validate the uptrend—otherwise, this could be a short-lived bounce. For now, DOGE remains a high-risk, speculative play in a market dominated by Bitcoin’s rally.