Ethereum Breaks Free From Consolidation

Ethereum (ETH) has finally broken out of its month-long trading range, surging past the $2,750 resistance level with conviction. After briefly touching $2,830 earlier today, the second-largest cryptocurrency by market cap is showing remarkable resilience, defying broader market uncertainty. This bullish momentum suggests that ETH could be gearing up for a sustained upward trajectory.

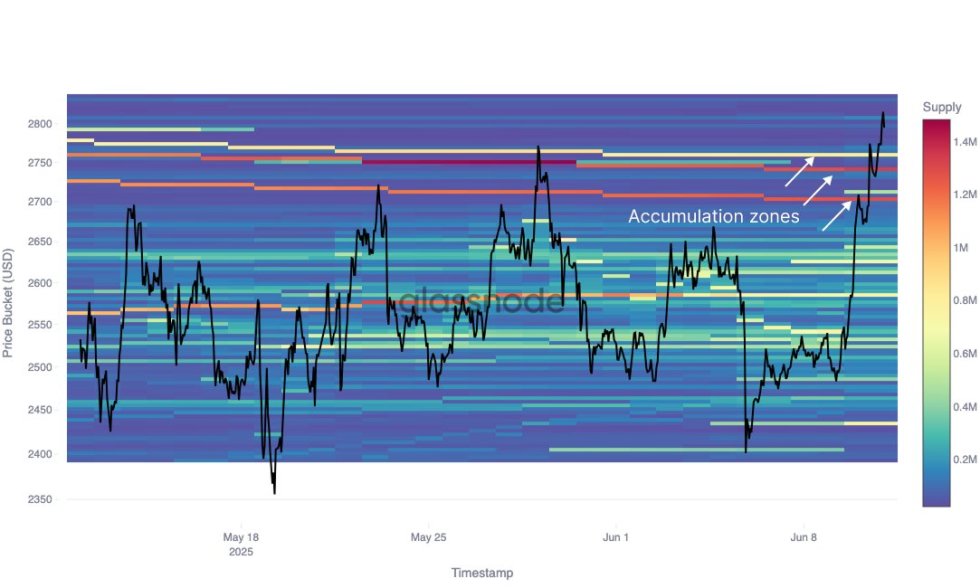

Strong Support at $2.7K–$2.74K

Analysts are closely watching the $2,700–$2,740 range, where approximately 1.3 million ETH is held. This concentration of holdings could act as a critical support zone, anchoring ETH’s price and preventing a steep pullback. The fact that buyers have stepped in consistently at these levels indicates strong accumulation by long-term holders and institutional investors.

What’s Driving Ethereum’s Rally?

Several factors are contributing to Ethereum’s recent breakout:

- DeFi and Institutional Interest: The growing adoption of decentralized finance (DeFi) applications on Ethereum continues to drive demand.

- ETF Speculation: Optimism around potential Ethereum ETF approvals is fueling investor confidence.

- Market Sentiment Shift: After weeks of sideways movement, traders are positioning for a bullish continuation.

What’s Next for ETH?

If Ethereum maintains its foothold above $2,750, the next major resistance levels to watch are $2,900 and $3,000. A decisive break above $3K could open the door for a larger rally, potentially targeting all-time highs later this year. However, traders should remain cautious—any failure to hold $2.7K could lead to a retest of lower support levels.

For now, the bulls are in control, and Ethereum’s technical structure suggests that this breakout may just be the beginning of a bigger move.