Connecticut Takes a Stand Against State Crypto Investments

Connecticut has officially joined the growing list of U.S. states opting out of cryptocurrency investments. Lawmakers recently passed a bill prohibiting the state from holding or investing in digital assets like Bitcoin, marking a significant shift in public financial policy. The legislation also introduces stricter regulations for money transmitters operating within the state.

What the New Bill Entails

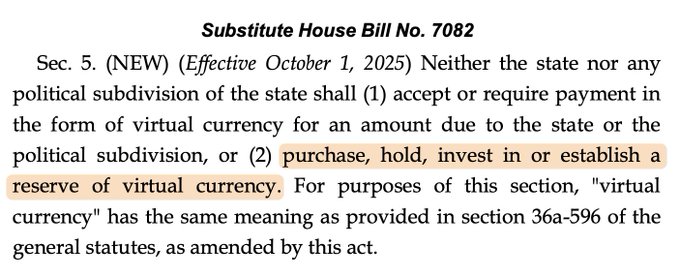

The newly passed bill includes two major provisions:

- Ban on State Crypto Holdings: Connecticut will no longer allocate public funds to cryptocurrencies or related investment vehicles, effectively removing the state from any Strategic Bitcoin Reserve (SBR) initiatives.

- Tighter Money Transmitter Rules: Businesses handling digital asset transactions must now comply with enhanced reporting and operational requirements, aiming to curb illicit activities like money laundering.

Why Connecticut Is Saying No to Crypto

While cryptocurrencies have gained traction among institutional and retail investors, state governments remain cautious. Connecticut’s decision reflects broader concerns about:

- Volatility Risks: The unpredictable nature of crypto markets poses financial stability risks for public funds.

- Regulatory Uncertainty: Lack of federal oversight complicates compliance and accountability.

- Security Threats: High-profile hacks and scams have eroded trust in digital asset ecosystems.

A Growing Trend Among States

Connecticut isn’t alone in its skepticism. States like New York and California have also imposed restrictions or are debating similar measures. Meanwhile, the federal government continues to grapple with crypto regulation, as seen in recent SEC lawsuits and legislative proposals like the CLARITY Act.

What’s Next for Crypto in Connecticut?

The ban doesn’t outlaw private crypto trading or blockchain innovation, but it signals a cautious approach. Advocates argue this could protect taxpayers, while critics warn it may stifle economic opportunities. As the debate heats up, all eyes are on whether other states will follow suit—or if federal policy will eventually override local bans.

For more on global crypto regulation, check out our coverage of Australia’s crackdown on a $123M laundering ring.