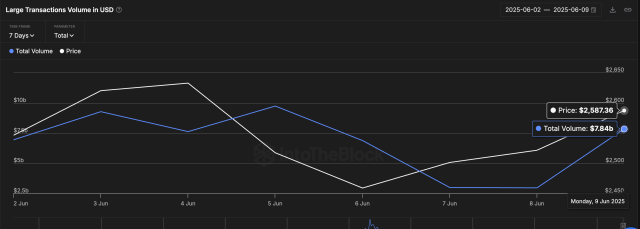

Ethereum Whales Are Back – What Does This Mean for the Market?

After weeks of sell-offs and sluggish price action, Ethereum (ETH) is showing signs of life again—and it’s largely thanks to the return of whale activity. Recent data reveals a staggering 100% increase in large ETH transactions within just 24 hours, sparking speculation that these deep-pocketed investors could be gearing up for an altcoin rally.

Why Are Whales Suddenly Active?

Ethereum whales—investors holding massive amounts of ETH—have been relatively quiet in recent weeks as the broader crypto market faced downward pressure. However, the sudden spike in large transactions suggests renewed confidence. Possible reasons include:

- Price Recovery: ETH’s recent uptick may have triggered accumulation strategies.

- Anticipation of Altcoin Season: Historically, ETH whale movements precede altcoin rallies.

- Institutional Interest: Growing institutional adoption could be driving demand.

Could This Spark an Altcoin Season?

Whale activity often serves as a leading indicator for market trends. When large holders accumulate ETH, it can signal bullish sentiment that spills over into other altcoins. Key factors to watch:

- ETH Dominance: If ETH’s market share grows, it may pull altcoins upward.

- Exchange Inflows/Outflows: Fewer ETH deposits to exchanges suggest long-term holding.

- DeFi and NFT Activity: Increased usage could further boost Ethereum’s appeal.

What Should Traders Do?

While whale movements are a positive sign, caution is still advised. Here’s how traders can navigate this phase:

- Monitor On-Chain Data: Track whale wallets and transaction trends.

- Diversify Strategically: Consider high-potential altcoins with strong fundamentals.

- Set Stop-Losses: Volatility remains a risk—protect your positions.

The resurgence of Ethereum whales is undeniably a bullish signal, but whether it translates into a full-blown altcoin season depends on broader market conditions. Keep an eye on ETH’s price action and network activity for clearer signals in the coming days.