Bitcoin Long-Term Holders Show Unwavering Confidence

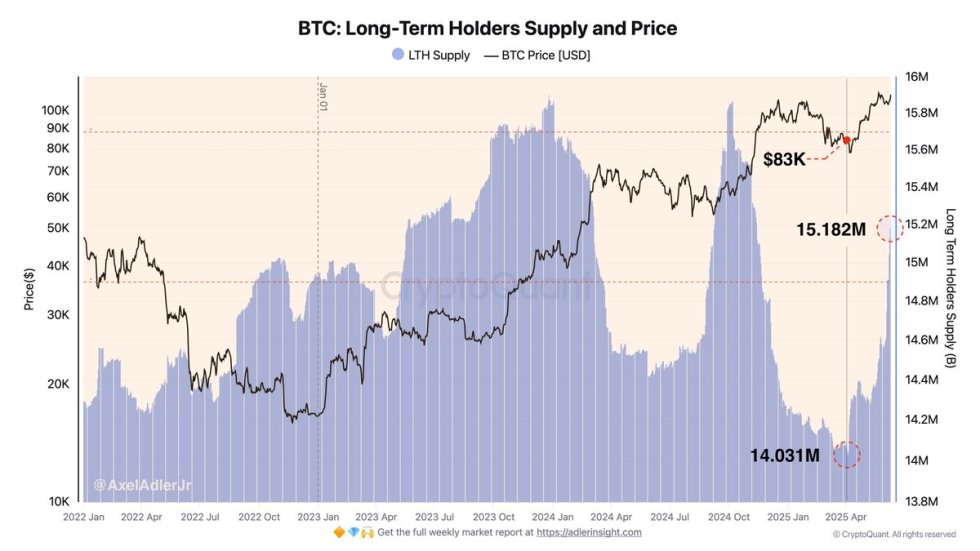

Bitcoin (BTC) continues to dominate headlines as long-term holders (LTHs) have significantly increased their holdings, accumulating an additional 1.151 million BTC in recent months. This surge in accumulation comes as Bitcoin trades near critical levels, recently surpassing the $110,000 mark—a milestone that highlights its bullish momentum. As of June 10, 2025, BTC remains just below its all-time high of $112,000, demonstrating resilience with strong support around $105,000.

Why Are Long-Term Holders Doubling Down?

Long-term holders—investors who retain Bitcoin for extended periods—are often seen as a barometer of market sentiment. Their recent accumulation suggests strong conviction in Bitcoin’s future potential. Several factors could be driving this behavior:

- Institutional Adoption: Growing interest from institutional investors, including ETFs and corporate treasuries, reinforces confidence in BTC as a store of value.

- Macroeconomic Uncertainty: With inflation concerns and geopolitical instability, Bitcoin remains a hedge against traditional market volatility.

- Upcoming Halving Cycle: Historical trends show that Bitcoin’s price tends to surge post-halving, incentivizing long-term holding.

Market Implications: Will the Rally Continue?

Bitcoin’s current price action suggests a tug-of-war between bullish momentum and profit-taking. However, the steadfast accumulation by LTHs indicates that many investors are betting on further upside. Key levels to watch include:

- Support at $105,000: A critical zone that could determine short-term price direction.

- Resistance at $112,000: Breaking this level may trigger a new wave of buying pressure.

Analysts are divided on whether Bitcoin will consolidate or push higher, but the behavior of long-term holders suggests that HODLing remains a favored strategy.

What Should Investors Watch For?

For traders and investors, monitoring these trends is crucial:

- Exchange Reserves: Declining BTC reserves on exchanges often precede price rallies.

- On-Chain Metrics: Metrics like realized cap and RSI can provide insights into market cycles.

- Regulatory Developments: Global crypto policies, such as MiCA in the EU, could impact market sentiment.

While short-term volatility is inevitable, Bitcoin’s long-term trajectory appears promising, especially with institutional and retail investors increasingly viewing it as digital gold.

Bottom Line: The accumulation by long-term holders signals strong confidence in Bitcoin’s future. Whether you’re a trader or a HODLer, keeping an eye on these trends could help navigate the next phase of the market.