Crypto Investment Products Continue Winning Streak

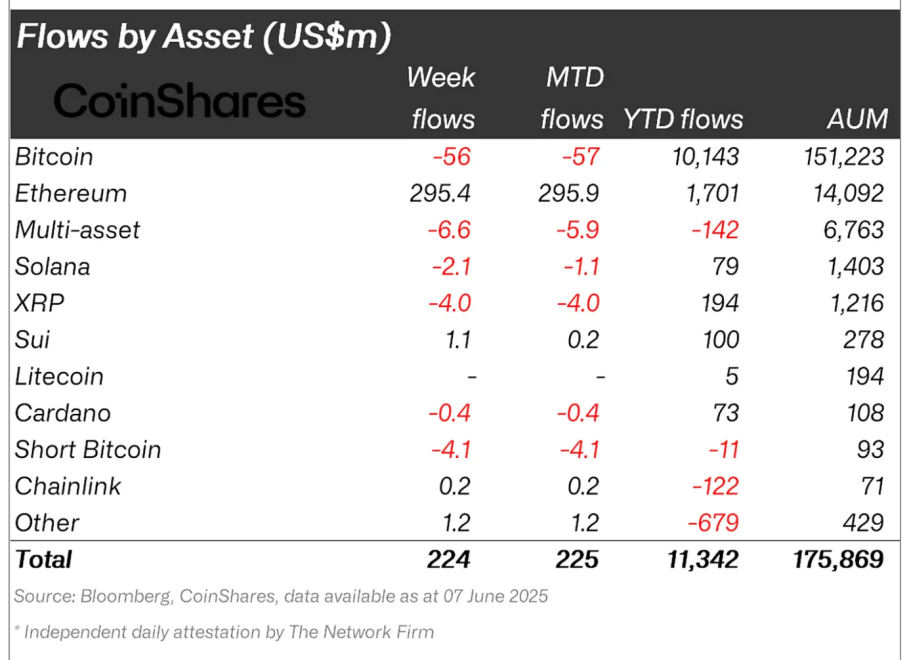

The cryptocurrency market is showing signs of sustained institutional interest, with digital asset investment products attracting $224 million in net inflows last week. According to CoinShares’ latest report, this marks the seventh consecutive week of positive flows, bringing the total accumulated inflows to a staggering $11 billion during this period.

Bitcoin’s Surprising Outflows Raise Questions

Despite the overall bullish trend, Bitcoin (BTC) experienced $13 million in outflows—a development that has analysts debating market sentiment. This contrasts sharply with Ethereum (ETH), which saw $10 million in inflows, suggesting a potential rotation among institutional investors.

Key Trends Driving the Market

- Regional Divergence: The U.S. dominated inflows with $225 million, while Europe saw minor outflows.

- Altcoin Momentum: Solana (SOL) and Litecoin (LTC) attracted $3.6M and $2.4M respectively.

- Short-Bitcoin Products: Outflows of $5.5M indicate declining bearish bets.

What’s Behind Bitcoin’s Outflows?

Experts speculate that profit-taking after BTC’s recent rally or a shift toward altcoins might explain the outflows. The approval of spot Bitcoin ETFs earlier this year continues to reshape investment patterns, with some investors possibly rebalancing portfolios.

“The data reveals nuanced behavior,” says James Butterfill, Head of Research at CoinShares. “While macro inflows reflect confidence, Bitcoin’s minor outflows suggest tactical adjustments rather than a loss of faith.”

Looking Ahead: Market Implications

The sustained inflows signal growing institutional adoption, but Bitcoin’s dip highlights the market’s complexity. Traders are advised to monitor:

- ETF flow trends in the U.S. and Europe

- Regulatory developments, particularly MiCA in the EU

- BTC’s price reaction to outflows

With $11 billion injected in just seven weeks, crypto investment products are clearly in demand—but as always in this volatile market, the devil is in the details.