The Quantum Clock is Ticking for Bitcoin

Bitcoin, the world’s first and most secure cryptocurrency, faces a theoretical but profound threat on the horizon: quantum computing. According to venture capitalist and crypto commentator Nic Carter, the time for developers to address this risk is now. Failure to act, he warns, could lead to a scenario where traditional institutions step in to “fix” the problem themselves, potentially leading to a fundamental shift in who controls the Bitcoin network.

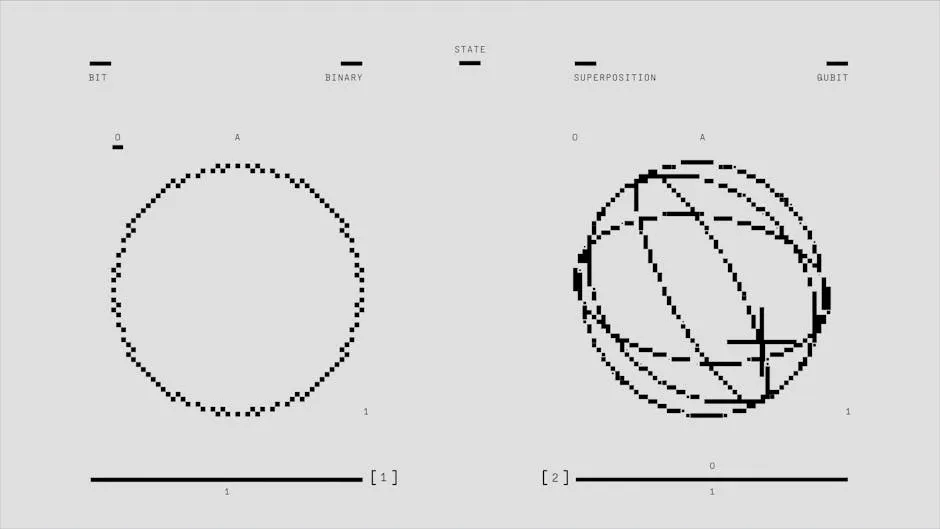

Understanding the Quantum Threat

At its core, the quantum risk to Bitcoin lies in its cryptographic foundations. Bitcoin’s security relies heavily on public-key cryptography, specifically the Elliptic Curve Digital Signature Algorithm (ECDSA). This is what allows users to securely sign transactions with their private keys. Current classical computers would take an impractically long time to crack these keys.

However, a sufficiently powerful quantum computer, leveraging algorithms like Shor’s algorithm, could theoretically break this encryption in a much shorter timeframe. If such a machine were built, it could allow a malicious actor to derive private keys from public addresses, potentially stealing funds from any wallet where the public key is visible on the blockchain.

Why Institutions Might Step In

Nic Carter’s central argument is that the threat isn’t just technological—it’s political and economic. As Bitcoin becomes more integrated into the global financial system, large institutions, corporations, and even governments are holding it on their balance sheets. These entities have a low tolerance for existential risk.

“If there’s a credible quantum threat that is not being addressed by the core development community, these institutions may get fed up,” Carter suggests. Their response could be to fund their own development teams or lobby for a swift, centralized protocol change to implement quantum-resistant cryptography. This top-down approach would stand in stark contrast to Bitcoin’s traditionally slow, decentralized, and consensus-driven upgrade process.

The Risk of a “Corporate Takeover”

This scenario is what Carter frames as a potential “corporate takeover.” The fear is that the urgent need to patch a critical vulnerability could override Bitcoin’s core ethos of decentralized governance. If a consortium of powerful financial players decides the upgrade path and timeline, they could effectively seize control of the protocol’s development direction, setting a dangerous precedent for the future.

The integrity of the network could be preserved, but the process by which it is saved might permanently alter the power dynamics within the Bitcoin ecosystem.

What Can Be Done?

The good news is that the cryptographic community has been aware of this threat for years. Research into “post-quantum cryptography” (PQC)—algorithms believed to be secure against both classical and quantum computers—is ongoing. The challenge for Bitcoin is immense, as any transition would need to be meticulously planned and executed with near-universal consensus, all while the network remains live and secure.

For developers and the broader community, the message is clear: proactive research and planning are non-negotiable. By beginning the long and complex conversation about quantum-resistant upgrades now, the Bitcoin ecosystem can work to safeguard not only its funds but also its cherished decentralized principles from future shock.